Improve your cash flow

Click here to schedule a call with a coach today

We all have months when expenses run hot and carry over to the next month. But when it keeps happening, it’s time to look at our spending and regain control.

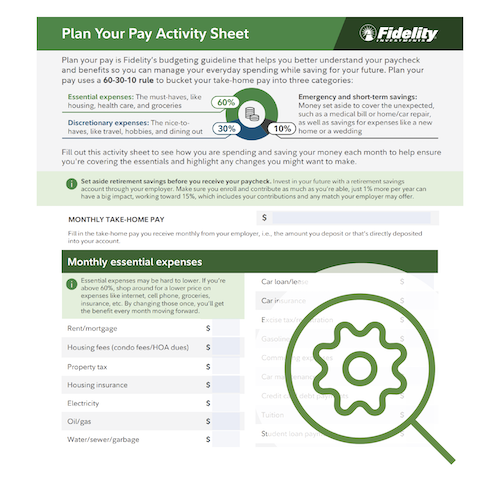

Most people don’t have the time or desire to do a detailed budget every month, so we’ll simplify this for you. Do it once a year. And, let’s not call it budgeting. Let’s Plan Your Pay, so you can get the most from each paycheck.

Resources to help you squeeze the most from each paycheck:

- Watch the Improve Your Cash Flow video

- Do the Plan Your Pay activity to help squeeze more from your paycheck

- Call 1-800-791-2363 or schedule time with a Coach to find ways to free up cash

Use the below worksheet to capture your current expenses. The video can help you get the numbers in the right place and think through your spending. Then call a Coach who can help you determine where to do some dollar squeezing and shifting to help free up cash for what’s most important to you.

WATCH

Improve Your Cash Flow

LEARN

Plan Your Pay activity sheet

Here are some “dollar squeezing” tips to help lower your expenses.

Groceries and Dining Out

- Develop and stick to a meal plan.

- Head out early to take advantage of Early Bird specials and Happy Hour food and beverage pricing

- Skip appetizers when the restaurant offers complimentary bread/chips, skip coffee, tea, soda, and alcohol at the restaurant, split a few smaller items.

- Buy in bulk for heavily used items.

- Use coupons and cancel wholesale memberships that you don’t use.

Commuting/Auto Expenses

- Choose cars that hold their value

- Check special leasing offers for cars that aren't selling quickly enough

- Make biweekly payments, resulting in 1 extra payment for the year

- Refinance car loan

- Consider selling a car you don't use

- Try to use public transportation instead of ride-share apps and taxis

- If your destination is within practical walking distance, walk or bike.

- Carpool and avoid rush-hour traffic

- Use application that search for the best gas prices, such as GasBuddy

Electricity and Oil/Gas

- Switch to energy-efficient appliances

- DIY smaller items such as fire alarm installation

- Install insulation and weather stripping

- Use smart power strips

- Regularly replace furnace filter

- Adjust thermostat

- Decrease temperature on water heater

- Proper insulation around the house and regular maintenance

Life Insurance Premiums

- Opt for term, rather than permanent insurance

- Buy sooner rather than later (premiums increase with age and deteriorating health)

- Pay annually if possible to avoid extra fees when premium is paid month-to-month

- Quit smoking & maintain a healthy lifestyle

Support of family members/loved ones

- Childcare co-op (bartering services instead of money)

- Take advantage of workplace benefits and referral networks

- Make sure your parents are utilizing every eligible benefit (Medicaid, etc.)

- Home monitoring systems instead of full-time assistance if practical

- Bartering caregiving services for unused rooms, cars, etc.

- Leverage eligible tax credits and deductions

Telephone/Cable/Internet Fees/Streaming Services

- Bundle internet & cable (package of channels you actually watch)

- Replace cable with multiple streaming services

- Choose a prepaid or smaller mobile data plan after monitoring data usage

- Negotiate your cost

- Shop with family or friends

Student Loan Payments

- For any unsubsidized student debt, investigate if you can refinance, and use the student loan interest deduction

- Make payments during your grace period, sign-up for autopay, and pay over the minimums if possible

- Consider an income-driven repayment plan

- Enroll in automatic payment programs

Medical Insurance

- Pick the right facility/institution for your care (i.e., urgent care vs. emergency room, smaller hospital vs. big-name hospital)

- Know what your policy covers and check for errors

- Choose in-network providers if possible

- Consider cost-sharing reductions - deductibles & co-payments

One last tip to spend smarter: Look back to look forward. Start reviewing your bank and credit card statements and circle purchases that weren’t worth the money (we all have some!). Make a mental list of the types of expenses you will avoid in future. Keep doing this each month until you cut down on “low value” spending.

CALL A COACH

Financial Wellness Coaches can help you learn how to spend less than you earn. You can either schedule time with a coach, or just call 1-800-791-2363.

Having your Plan Your Pay worksheet available will help you get the most from the session (but not required).